MONTGOMERY – There’s a little Christmas bonus in the mail for Alabama taxpayers.

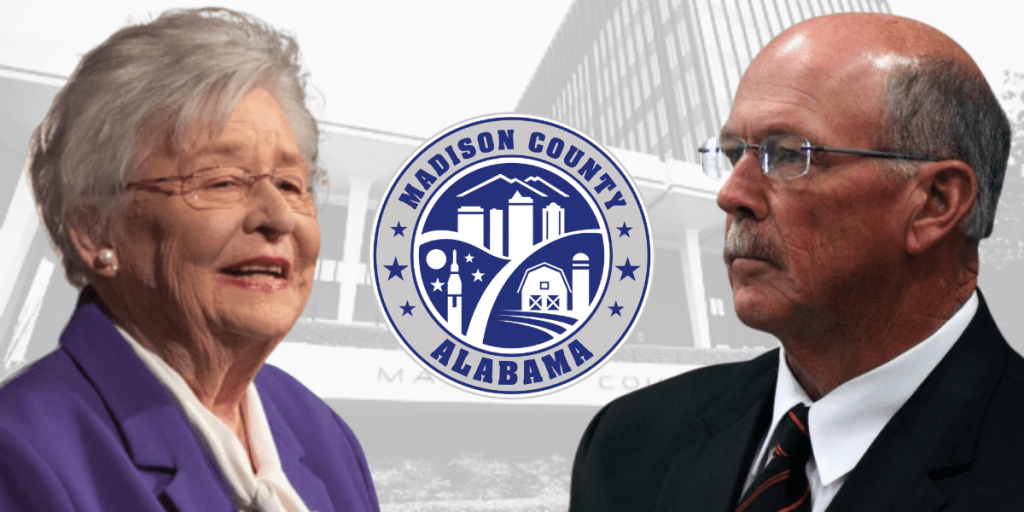

Gov. Kay Ivey announced today that one-time tax rebates authorized in her 2023 budget are now on their way to 1.9 million Alabama tax filers.

Since last Thursday, which was the start date authorized by law, officials have worked around-the-clock to process the one-time tax rebates. Ivey tasked the Department of Revenue with returning this money to Alabamians as expeditiously as possible.

Ivey said more than 500,000 rebate checks and some 850,000 direct deposits have been processed, many of which have been delivered.

“As the country continues to face tough times, Alabama taxpayers are working harder to stretch their paychecks to cover expenses, and for some, this little bit goes a long way,” said Ivey. “Most of the rebate funds should arrive by mid-December. In fact, I am already hearing from many who have received their rebates.”

To qualify for the rebates, taxpayers must have filed a 2021 Individual Income Tax return which the Alabama Department of Revenue received on or before Oct. 17, 2022. Non-residents, estates or trusts or anyone who was claimed as a dependent during the 2021 tax year do not qualify.

The amount of each rebate is based on the qualified taxpayer’s filing status:

- $150 for single, head of family, and married filing separate

- $300 for married filing jointly

If you are eligible for a rebate and have not received it by December 15, please call the Alabama Department of Revenue at 334-242-1170, and select option 1.