MADISON — The list of cities and others opposing the state Department of Revenue and the Simplified Sellers Use Tax (SSUT) law has grown by one more.

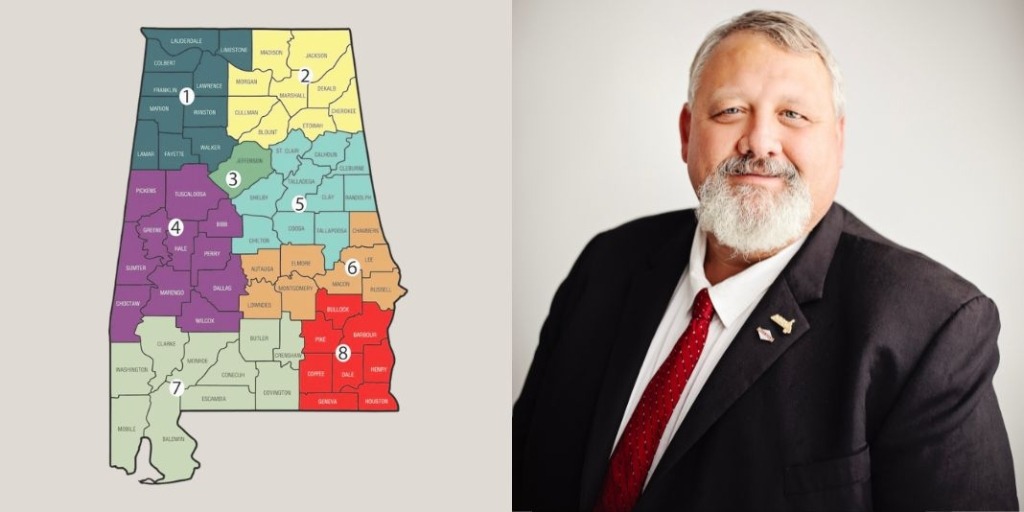

The Madison City Council voted 5-2 Monday night to join the lawsuit with Mobile, Hoover, Tuscaloosa, Mountain Brook and Tuscaloosa City Schools arguing that participating merchants with physical presences in Alabama should be paying traditional state and local sales taxes.

The Montgomery County Circuit Court, where the lawsuit was filed, set a Dec. 10 deadline to join the lawsuit originally brought by Tuscaloosa.

In the lawsuit, the municipalities want the state to revamp the tax collection system so retailers with stores and facilities in the state remit to the state for online purchases the same state and local taxes they would for in-store purchases.

The 8% tax on online purchases began in 2016. According to the SSUT, 50% of online sales tax revenue collected goes to the state where it is further split – 75% to the state General Fund and 25% to the Education Trust Fund. The other half is split among local governments – 40% to counties on a population basis and 60% to municipalities on a population basis.

The Decatur City Council voted Monday to support the effort to change the tax, but did not join the lawsuit.

“The Simplified Sellers Use Tax is not being handled in a way that treats cities fairly,” Mayor Kent Lawrence said. “The distribution is uneven, shortchanging communities like ours. I support efforts to correct this process. The lawsuit filed by other Alabama cities aims to fix how SSUT dollars are administered and allocated.

“If the City Council chooses to adopt a resolution of support, I am fully on board. Our goal is fair treatment, clear rules, and a stronger future for Decatur.”

At its work session last week, the Madison City Council heard a presentation from Tuscaloosa Mayor Walt Maddox and members of his team on the structure of SSUT, the challenges it creates for municipalities, and why Tuscaloosa is pursuing legal action related to the issue.

Madison City Council President Maura Wroblewski, who voted to join the lawsuit, said the council has an obligation to make sure the city’s taxpayers get the most out of their tax dollars.

“We are to be good stewards of the resources that are given to us by our taxpayers,” she said. “I think they would want us to fight for every penny, nickel and dime.”

Councilmen David Bier and Michael McKay voted against joining the suit, citing costs.

In a statement after the vote, the city said, “Recognizing that Madison taxpayers have the right to receive the benefit from the tax dollars they pay, the Madison City Council will continue to communicate with elected officials on the importance of revising the SSUT law to fairly distribute local tax dollars and advocate for the Madison taxpayer.”

Because it is now involved in the lawsuit, city officials said they are unable to provide further comment at this time.

“The city remains committed to protecting the long-term financial stability of our community and ensuring fair and equitable tax policies for all Alabama municipalities,” the statement said.