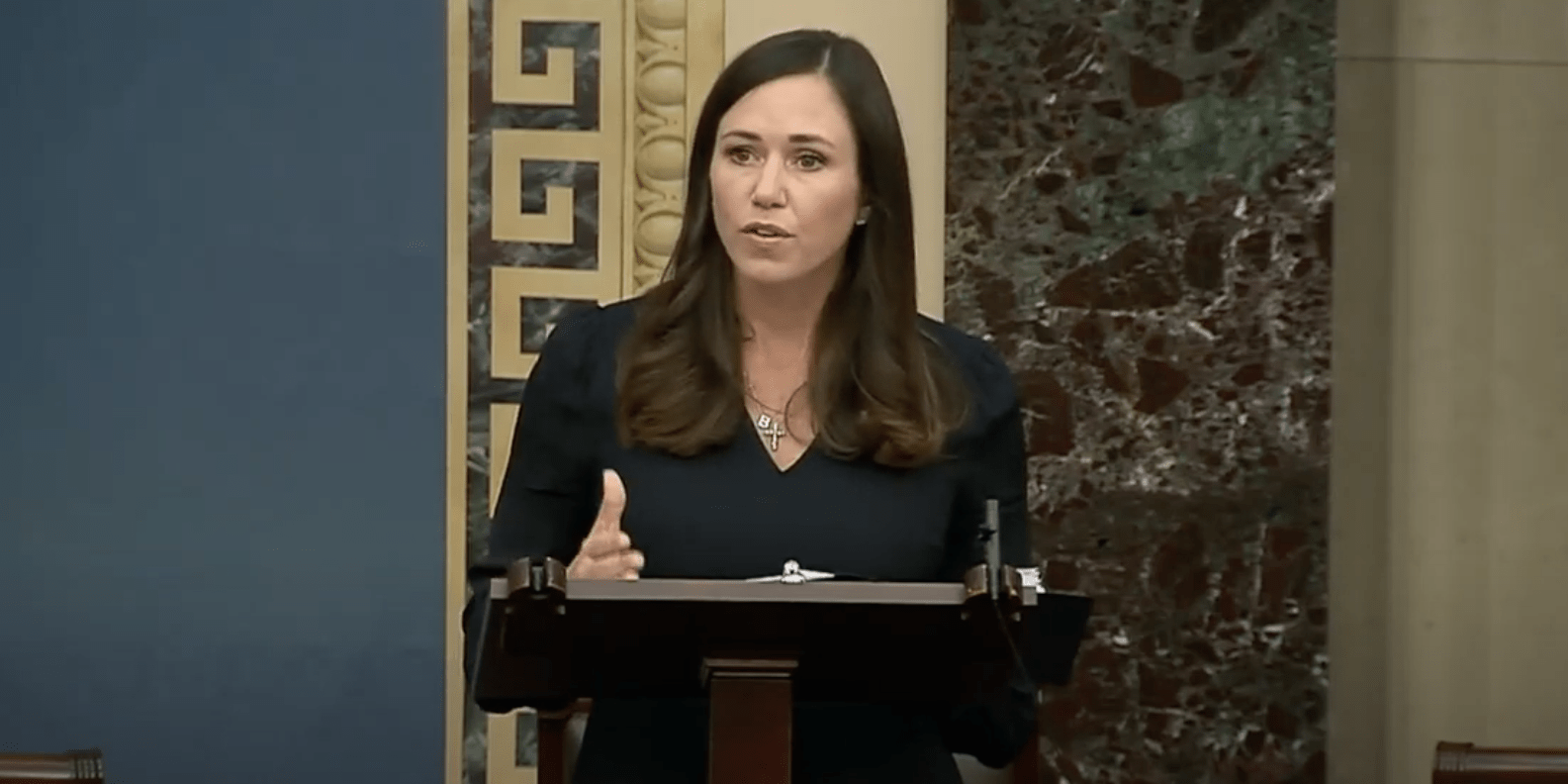

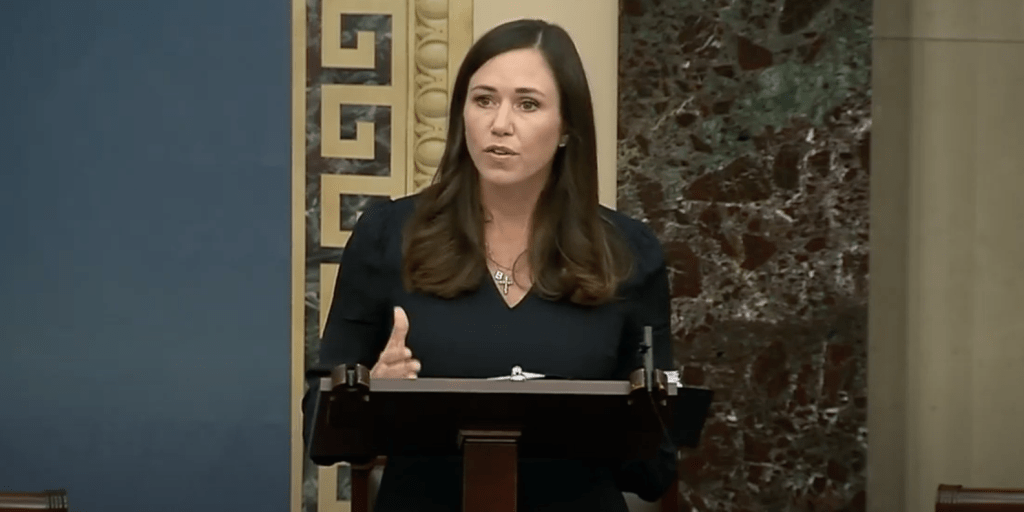

WASHINGTON — Bipartisan legislation to redefine “small entities” and prevent burdensome requirements on small businesses has been introduced in Congress, Sen. Katie Britt announced.

Britt (R-Montgomery) and Sen. Andy Kim have introduced the Small Entity Update Act to modernize the Security and Exchange Commission’s regulatory framework to provide relief for small businesses and entrepreneurs.

This bill is the Senate companion to legislation in the U.S. House of Representatives introduced by Rep. Ann Wagner (R-Mo.).

The bipartisan legislation would direct the SEC to update its outdated definition of “small entity” and assess the costs of regulatory compliance for these small and growing businesses. This would ensure current and future rulemakings from the SEC do not impose unnecessary or overly burdensome requirements on these businesses.

“Alabama’s small businesses create opportunity, jobs, and economic growth throughout the state, and our small investment advisers help to provide financial guidance and personalized services for so many families, entrepreneurs, and businesses planning for their financial futures,” said Britt (R-Montgomery). “My legislation, the Small Entity Update Act, would ensure these small entities across the state and country are not unduly impacted by onerous regulations so they can continue to play pivotal roles in our economy.

“It is paramount that the SEC considers the unique challenges facing our smallest businesses when issuing any future rulemakings.”

Under the Regulatory Flexibility Act of 1980, the SEC is required to assess the impact of their rules on “small entities,” and if there is a significant or overly burdensome impact on these businesses, the agency must consider alternatives that minimize that impact.

Currently, the SEC’s definition of a “small entity”, which has not been updated in more than 25 years, only includes small investment advisers with less than $25 million in assets under management (AUM).

However, the threshold for SEC registration is currently set at $100 million AUM – with limited exceptions – making the current “small entity” definition virtually meaningless. This severely outdated definition effectively excludes all small investment advisers and small businesses under the SEC’s purview from the protections and considerations intended by the Regulatory Flexibility Act.

“Every entrepreneur deserves a fair shot at success, free from outdated and overburdensome red tape,” said Kim (D-N.J.). “This bill is a straightforward way we can modernize and stand by our smallest businesses so they can continue to contribute to our local communities and economies.”

This bill would require the SEC to assess the growth of U.S. financial markets and the costs of regulations since the agency last amended its “small entity” definition and issue a rulemaking to adjust the definition consistent with the results of the study, along with suggestions on reducing regulatory burdens on small entities.

The bill would then tie the updated threshold to inflation, to be updated every five years.