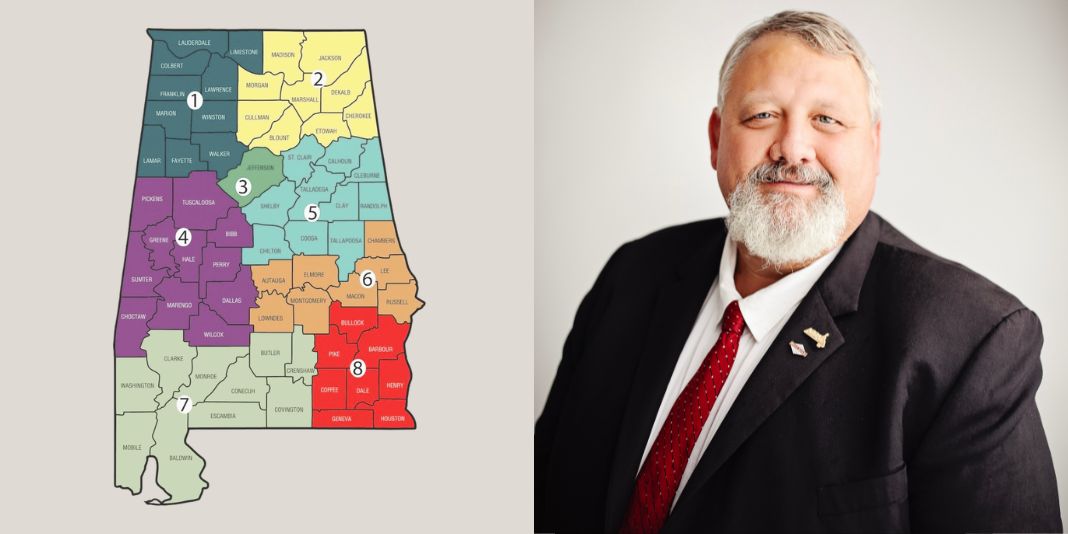

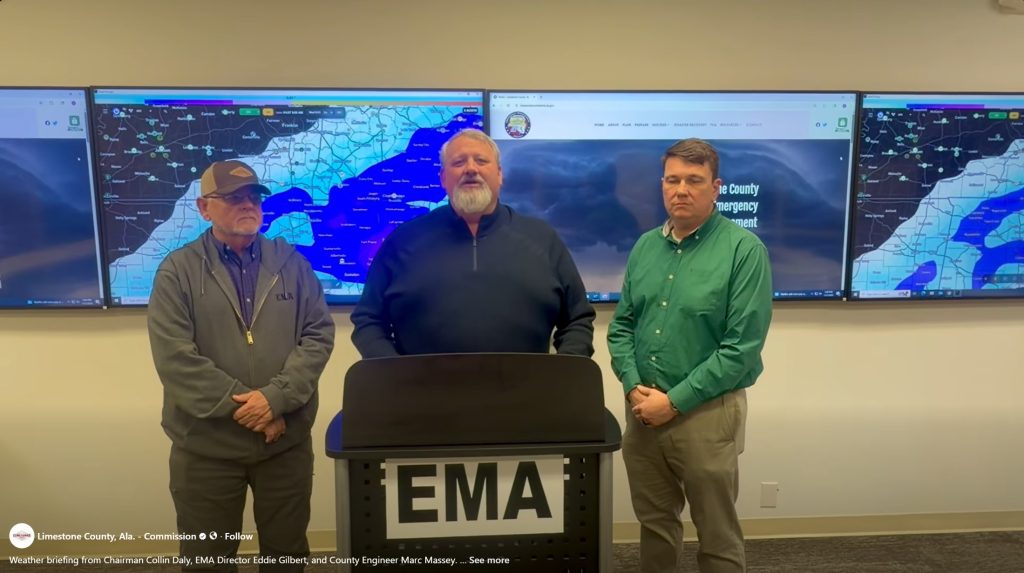

As Madison and several other large Alabama cities withdraw their lawsuit over the state’s online sales tax system and turn to lawmakers for a fix, Limestone County Commission Chairman Collin Daly says counties are standing firm.

Daly, who also serves as vice president of the Association of County Commissions of Alabama and is set to become its president in August, said all 67 counties have passed a resolution supporting the current Simplified Sellers Use Tax structure.

“Well, I mean, our stance is to leave it alone,” Daly said. “We’re 67 counties, we’re one voice and all 67 counties passed a resolution to stand to keep it like it is.”

The SSUT, created in 2016, collects an 8 percent tax on online purchases. Half of the revenue goes to the state, while the remaining half is distributed to local governments, with 40 percent going to counties and 60 percent to municipalities based on population.

Cities, including Madison, have argued the structure does not follow traditional destination-based sales tax principles and does not return the same level of revenue they would receive if purchases were made at local stores. This week, Madison voluntarily dismissed its lawsuit to pursue a legislative solution during the current session.

For Daly, the focus is on what the tax means for counties across Alabama.

“It helps our general funds,” he said. “That’s a lot of where we’re getting our supplementary money from is from SSUT.”

He described the revenue as “growth money” for counties, particularly when it comes to funding law enforcement and other essential services.

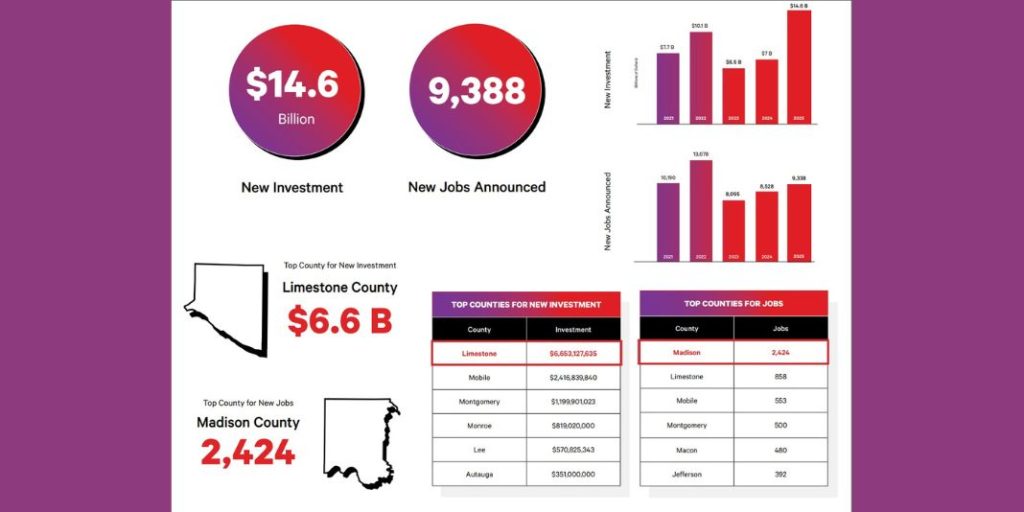

Daly said while fast-growing counties like Limestone have other revenue streams, many smaller counties do not.

“It wouldn’t be as devastating to me if they took some of it,” he said. “But some of these smaller counties, you take the Black Belt areas of the state. If it wasn’t for things like SSUT and all that, they couldn’t pay law enforcement, they couldn’t keep the lights on.”

“There’s some counties in the state of Alabama that have nothing more than a Dollar General,” he added.

Daly also defended the fairness of the current system.

“I think it’s constitutional. I think it’s fair,” he said.

Daly did point out if changes are to be made, the disadvantage to brick and mortar businesses should be addressed. He said that many Alabama cities have local sales tax rates above 9 percent, while the SSUT rate is 8 percent.

“So really you’re doing a disadvantage or disservice to the brick and mortar buildings because you’re giving the online salespeople a cheaper break,” Daly said.

As the debate shifts from the courtroom to the State House, Daly said his role with ACCA means advocating for all counties, not just his own.

“I’ve gone to Montgomery and fought for things that did not affect Limestone County, but affected us as a whole,” he said. “That’s what I’m saying about the 67 one voice. That’s our slogan. We’re going to stick with it.”

With more than $851 million generated through SSUT in 2024, lawmakers are expected to face continued pressure from cities seeking changes. But Daly made it clear that counties are unified heading into those discussions.

“We are 67 counties. One voice,” he said.