HUNTSVILLE – The North Alabama residential real estate market is finally seeing a wish come true as inventory saw a considerable jump, according to the quarterly Economic Report by the University of Alabama in Huntsville College of Business and the Huntsville Area Association of Realtors.

Perhaps, though, that is not the best news considering there are more houses on the market due to higher interest rates discouraging homebuying. According to the report, the national average 30-year mortgage rate has more than doubled from 2021 to 6.7% in September.

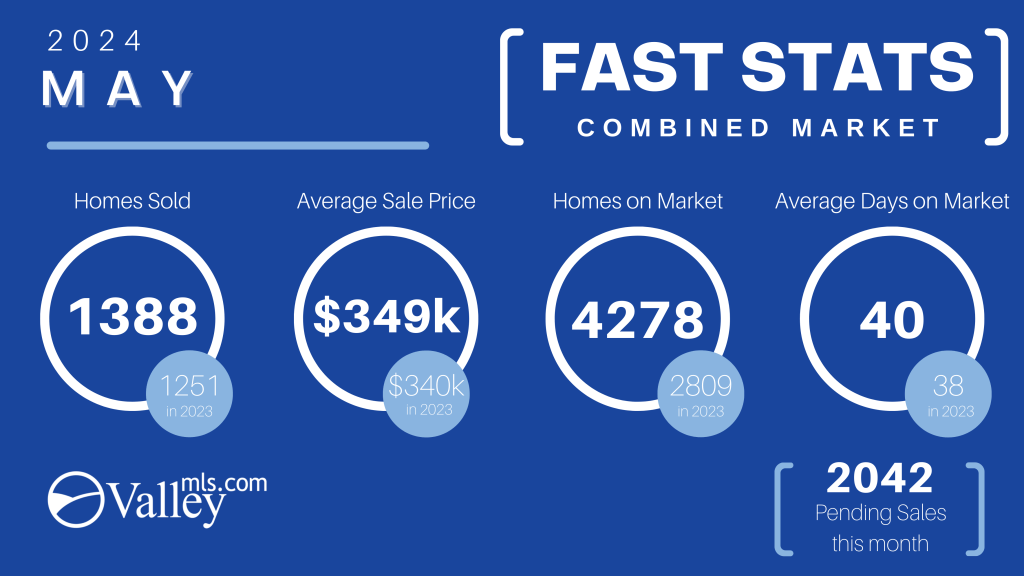

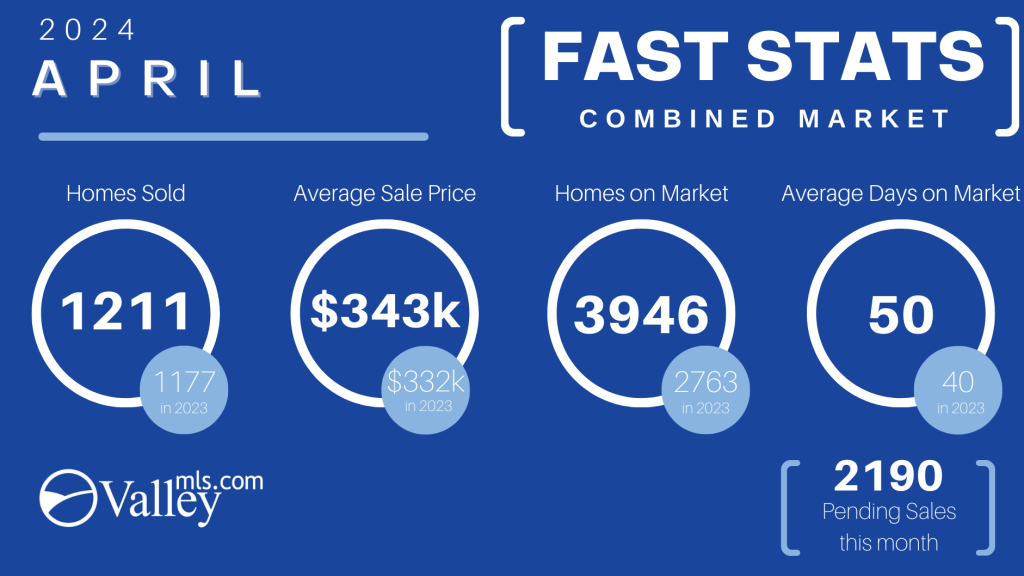

The inventory of homes rose 42% in the third quarter this year, compared to the second quarter. Even more eye-opening, the number of homes available increased a whopping 95% from a year ago.

Median home prices across the region moderated in the last quarter to $336,000 – 14.9% above the same time last year, but down 1% from this spring.

Much work remains to be done to increase inventory in the less than $350,000 price points, as attainability remains a top priority at HAAR,” said HAAR President Isaac Winkles.

That moderation is seen in sales figures with 38% of homes selling above list price this quarter while 35% sold at the asking price. The number of sales below asking price rose to 27% this quarter from 15% in the spring.

Winkles said the “balancing act” is attributed to inflation being at the front of mind of potential homebuyers as it reached 8.2% in September.

According to the Mortgage Bankers Association, buyers nationwide are hitting a wall of affordability as the interest rate tops 7% and some homebuyers face payments nearly 75% higher than a year ago. The association said it does not project a rebound until 2024 as the Federal Reserve eases monetary policy.

For more information about the North Alabama housing market, click here.