Alabama working families are facing an extra $87.7 million in state income taxes resulting from the federal COVID-19 relief legislation passed last year. The legislation increased the child tax credit, the dependent care credit and the earned income tax credit. Taxpayers must have earned income from work to qualify for the earned income credit and the dependent care credit, however Alabama law does not exclude pandemic-related federal tax benefits from income that can be taxed by the state.

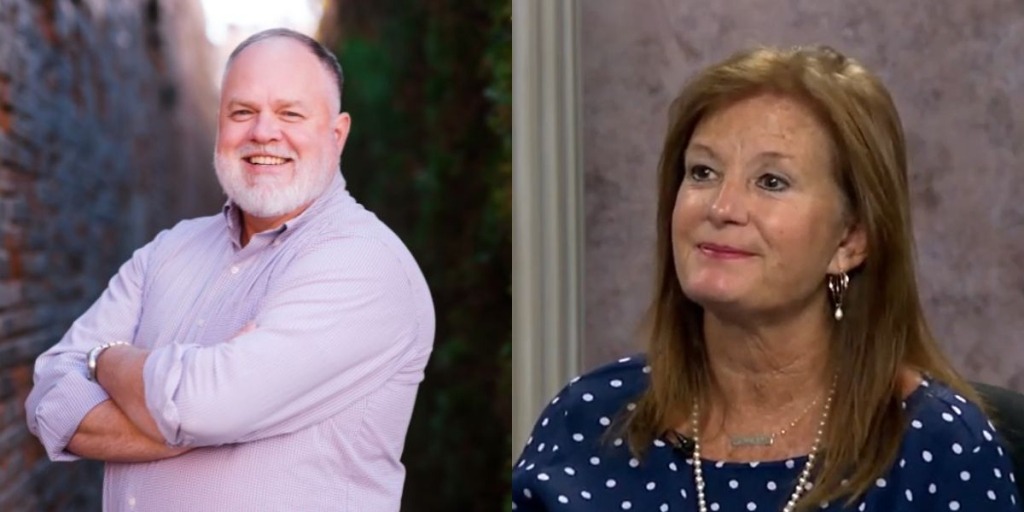

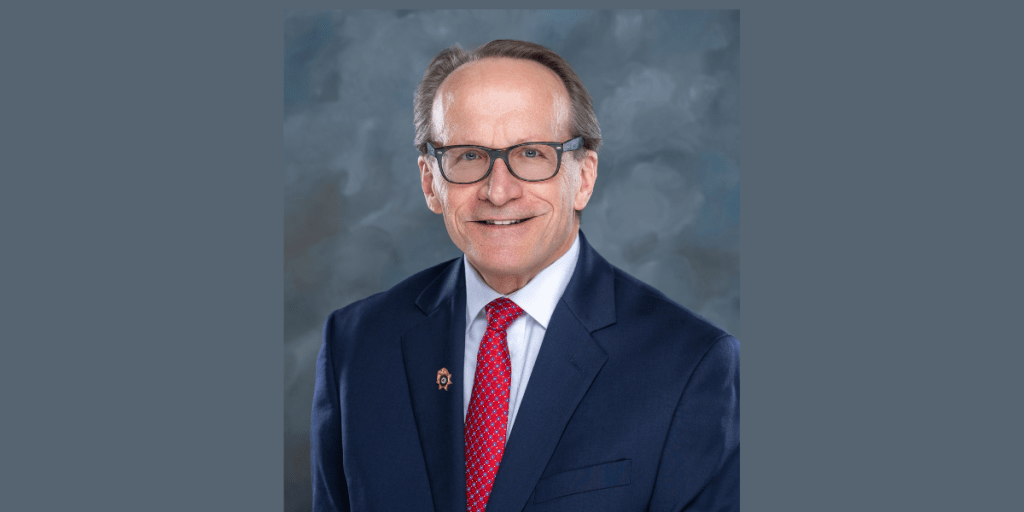

A bill sponsored by Sen. Dan Roberts (R-Mountain Brook) is set to be reintroduced to the Alabama Senate tomorrow, Feb. 1. It will write the exclusion into state law so that Alabama families will not have to pay additional taxes on the credits they received in 2021 from the federal COVID-19 relief bill.

“If we do not pass this bill, then we are choosing to impose an extra $87.7 million in taxes on hardworking Alabamians who qualified for tax relief because they showed up for work during the pandemic while some others walked off the job to collect higher unemployment benefits,” said Senator Roberts. “I don’t think that’s fair to our nurses, ambulance drivers, police officers, and so many others who stayed on the job during these tough times.”

Similar legislation was needed last year to prevent the state from taxing COVID-19 relief stimulus funds. Senator Roberts also sponsored that legislation, which was signed into law on February 12, 2021.

“This money belongs to the people, not the state government. With tax filing season already upon us, the legislature must act quickly to protect working families from this looming tax hike,” Roberts said. “Doing otherwise would be unconscionable.”

The timing is important because according to Roberts, if the legislature waits to pass the bill, many taxpayers will face having to file amended tax returns to keep from paying the extra taxes.

Roberts’ bill has attracted significant bipartisan support, gaining 29 co-sponsors in the Senate from both sides of the aisle. The bill has been referred to the Senate Committee on Finance and Taxation General Fund.