HUNTSVILLE — High mortgage rates and inflation last year helped quell the area’s hot housing market, according to the latest report from the Huntsville Area Association of Realtors.

The report for the fourth quarter of last year showed an improvement in the availability of homes, due to moderating sales.

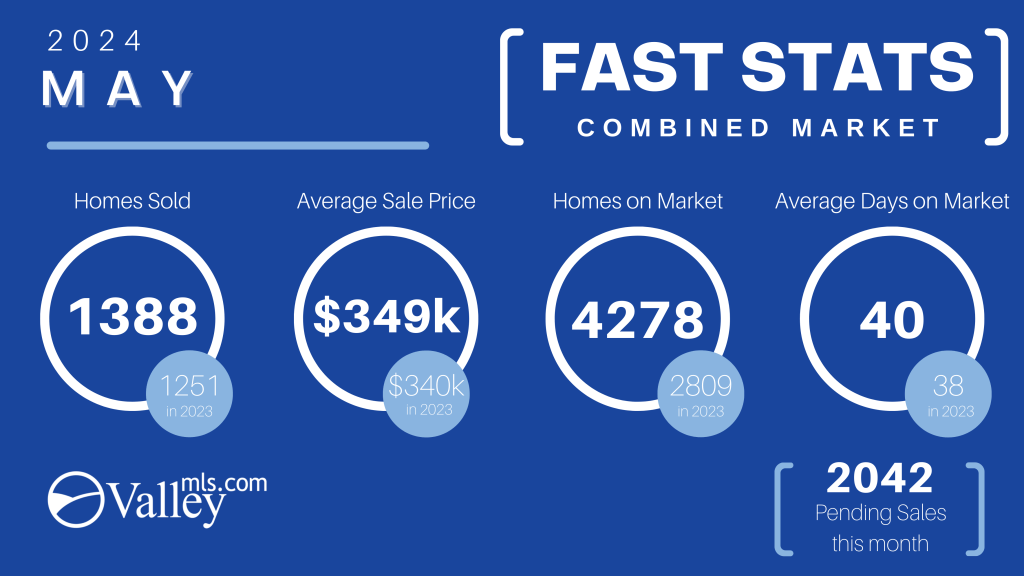

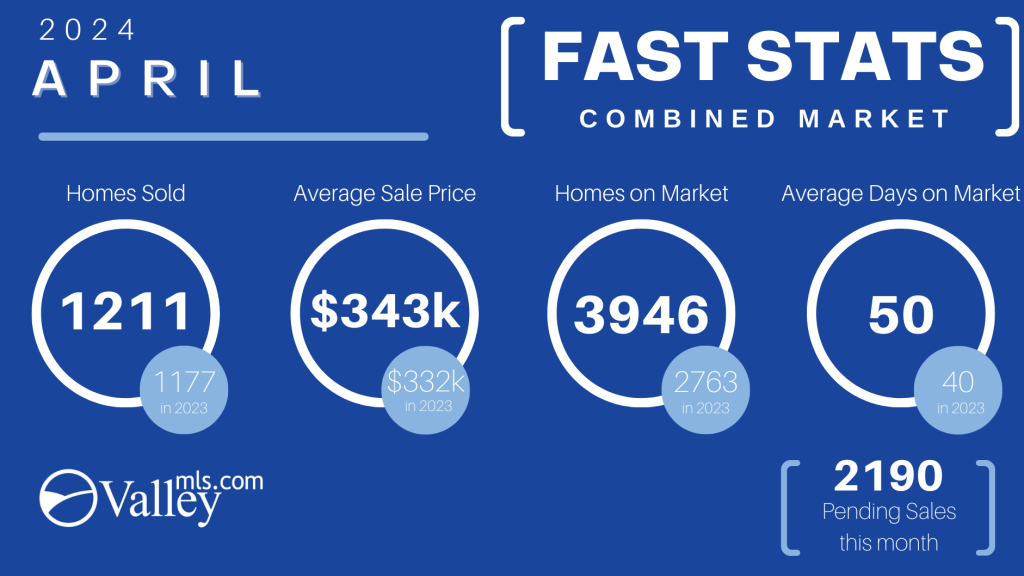

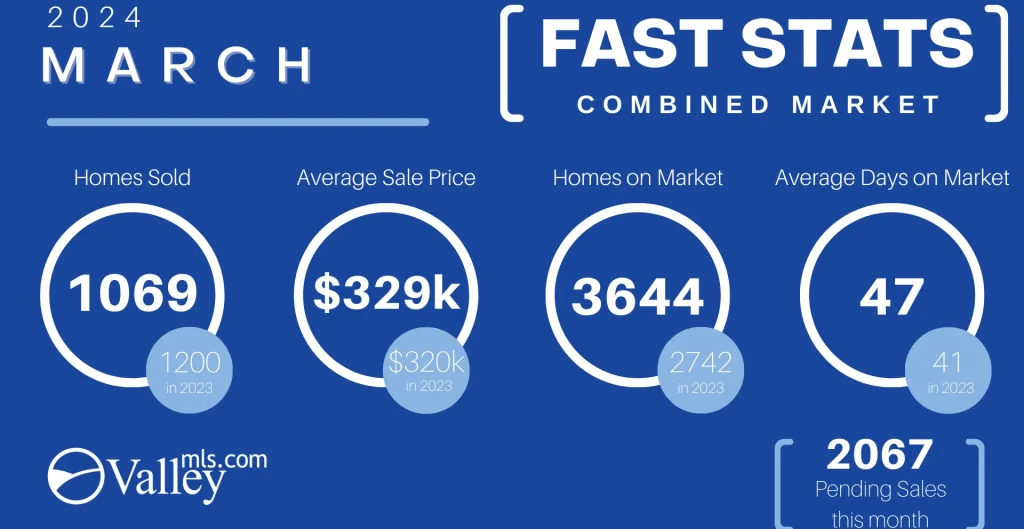

“Sales in the second half of the year began to moderate which allowed the inventory of available homes to grow,” the report said. “Some of the headwinds for housing sales included consumer inflation increasing to levels not seen in decades and mortgage rates doubled significantly, affecting housing affordability in the local market.”

Prices remained elevated while days on market stayed well below one-month, the report said.

However, the strength of the local economy continues to attract residents as well as provide new opportunities for current residents. This helped keep housing demand strong even with the challenges of inflation, workforce attraction, and recovery from the pandemic.

Seller expectations and buyer demands became more aligned which helped in rebalancing the overall housing market in Madison County, the report said.

The fourth quarter report can be read here.

Fourth quarter highlights

- Home prices moderated in the 4Q with the median price of $329,900, down from the 3Q level of $336,000.

- Inventory of homes increased significantly during the quarter with the number of homes available remaining above the number of units sold.

- Percentage of homes in the lower price ranges was smaller for both the number sold as well as the number available in the inventory of homes.

- The greatest number of listed homes at year-end (459) was in the $350,000-$500,000 range