While many states continue raising taxes, Alabama is holding the line.

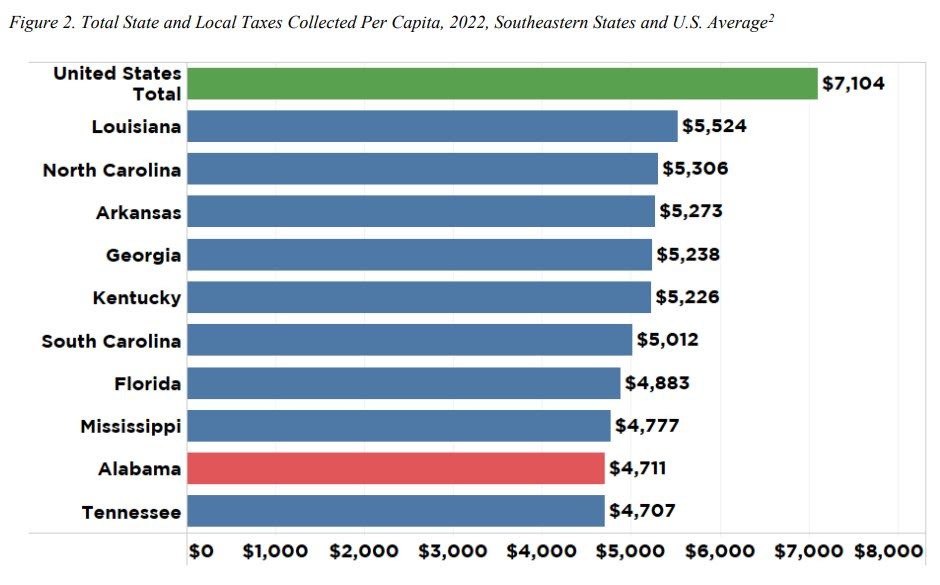

A new report from the Public Affairs Research Council of Alabama (PARCA) shows Alabama continues to rank near the bottom nationally in state and local tax collections, a result of a tax system that relies heavily on sales taxes while keeping property taxes among the lowest in the country.

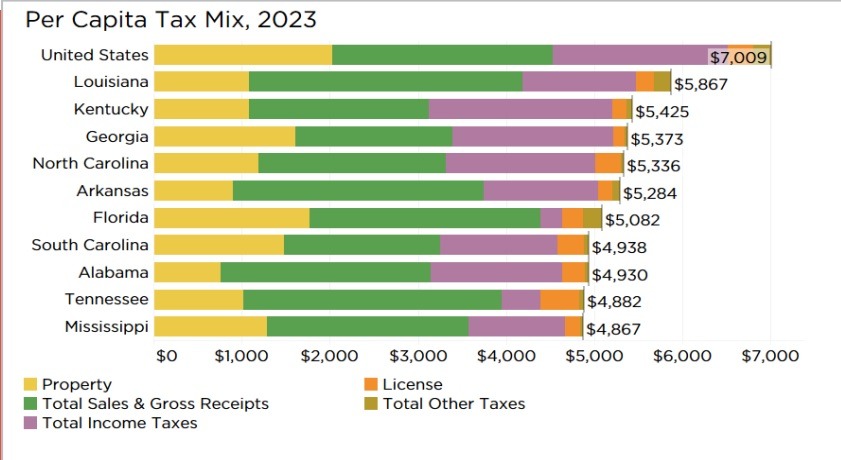

According to PARCA’s “How Alabama Taxes Compare, 2025 Edition,” Alabama state and local governments collected $4,930 per capita in taxes during fiscal year 2023, placing the state ahead of only Mississippi and Tennessee.

The report draws on data from the U.S. Census Bureau’s Annual Survey of State and Local Government Finances and compares Alabama’s tax structure with other states across major revenue sources.

Tax talk in figures: How Alabama measures up

-

State and local taxes per capita (FY 2023): $4,930 (bottom three nationally)

-

Property taxes: Lowest per-capita collections in the United States

-

Sales taxes: Among the highest combined state and local rates nationally

-

Sales tax on food: Reduced from 4% to 2% by 2025

-

Income tax brackets: Three brackets (2%, 4%, 5%), unchanged since the 1930s

-

Federal income tax deduction: Fully allowed, reducing state revenue by an estimated $818 million

-

Tax burden as share of personal income: About 9% (38th nationally)

-

Tax burden as share of GDP: About 8.2%, near the national middle

-

Selective taxes: Alcohol and utility taxes rank high; cigarette taxes remain low

-

Online sales taxes: Collections increased through the Simplified Sellers Use Tax (SSUT)

Lowest property taxes in the nation

PARCA reports Alabama has the lowest per-capita property tax collections in the country. While low property taxes reduce costs for homeowners, farms and timberland owners, they also limit revenue for local governments that depend on property taxes to fund schools, public safety and other basic services.

Alabama’s sales taxes pull their weight

To compensate for low property tax collections, Alabama relies more heavily on sales taxes than most states. Combined state and local sales tax rates rank among the highest nationally, though the state has gradually reduced the tax on groceries in recent years.

Income tax structure unchanged for decades

The report notes Alabama’s individual income tax structure has remained largely unchanged since the 1930s, providing predictability for residents and businesses alike. Alabama is also one of the few states that allows taxpayers to fully deduct federal income taxes paid, further reducing what Alabamians pay at the state level.

Overall tax pressure? Alabama makes it easy on residents

Despite high sales tax rates, Alabama’s overall tax collections remain comparatively low. PARCA found the state ranks 38th nationally in state and local taxes as a share of personal income, underscoring how the state’s tax mix shapes both revenue levels and who bears the tax burden.