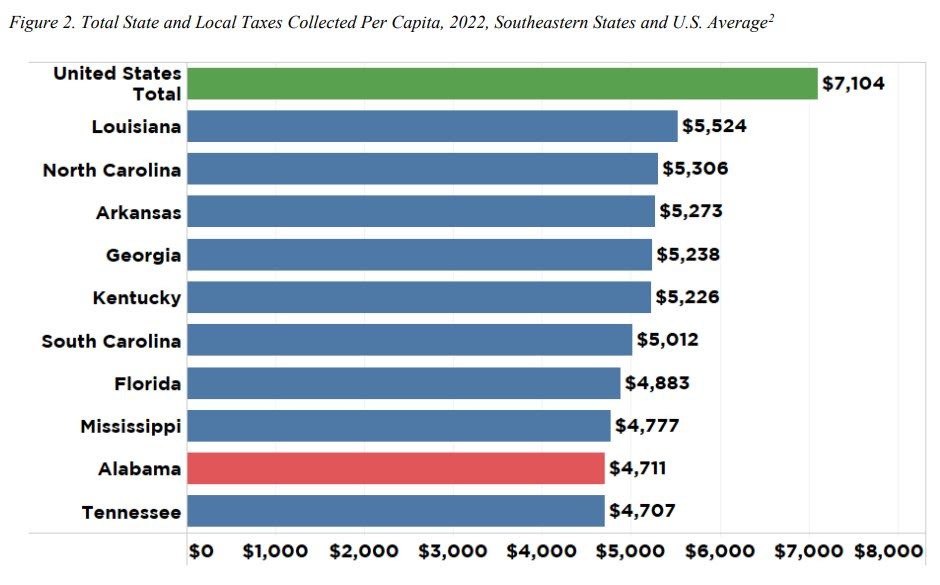

BIRMINGHAM — Each year, the Public Affairs Research Council of Alabama uses data from the U.S. Census Bureau’s annual survey of state and local finances to compare Alabama’s tax collections to the other states.

The most recent data comes from the 2022 Fiscal Year.

Some key findings are:

- In FY 2022, adjusted for population, Alabama collected less in state and local taxes than all but one other state, Tennessee.

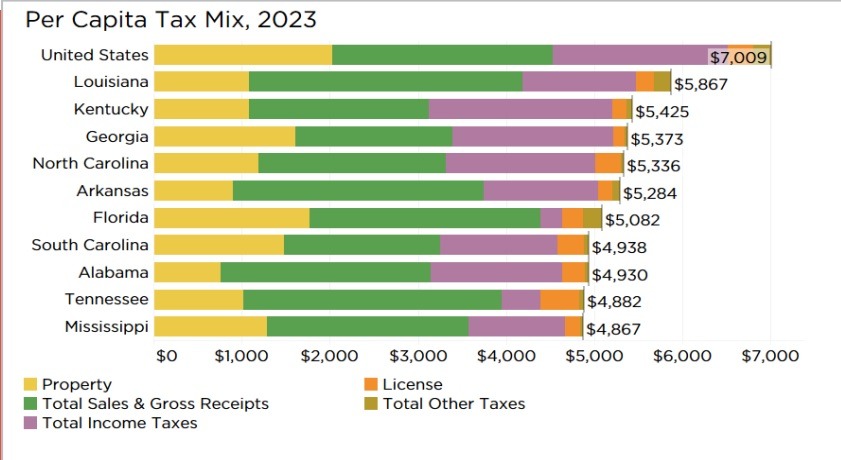

- Alabama’s per capita property tax collections are the lowest in the nation. That helps owners of homes, farms, and timberland but creates a revenue deficit, leaving state and local governments with less to spend on providing government services such as education, health, and public safety.

- Alabama’s state and local sales tax rates are among the highest in the U.S., compensating for low property taxes.

- Alabama’s income tax does not provide the balancing effect income taxes in other states do. Low-income workers begin paying taxes at a lower threshold than any other state. At the other end of the spectrum, Alabama is the only state that allows a full deduction for federal income taxes paid, a tax break that benefits high-income earners.

Alabama’s rankings in per capita state and local tax collection were generally consistent with prior years.

For most of the past 30 years, Alabama has consistently ranked last in the Southeast and last in the U.S. in terms of per capita tax collections. In recent years, Alabama has traded that last-place spot back and forth with Tennessee, thanks to tax-cutting measures in that state.

This year, according to the Census survey, Tennessee returned to the bottom spot, collecting $4 less per capita than Alabama. Tennessee’s income tax on dividends continues to decrease as the state phases it out.

For more information about Alabama taxes and how revenue and expenditures of state and local governments compare across the nation, click here.