WASHINGTON – As access to broadband advances through the state and the country, Sen. Tommy Tuberville reintroduced legislation to ensure rural communities can take the on- ramps to the information superhighway.

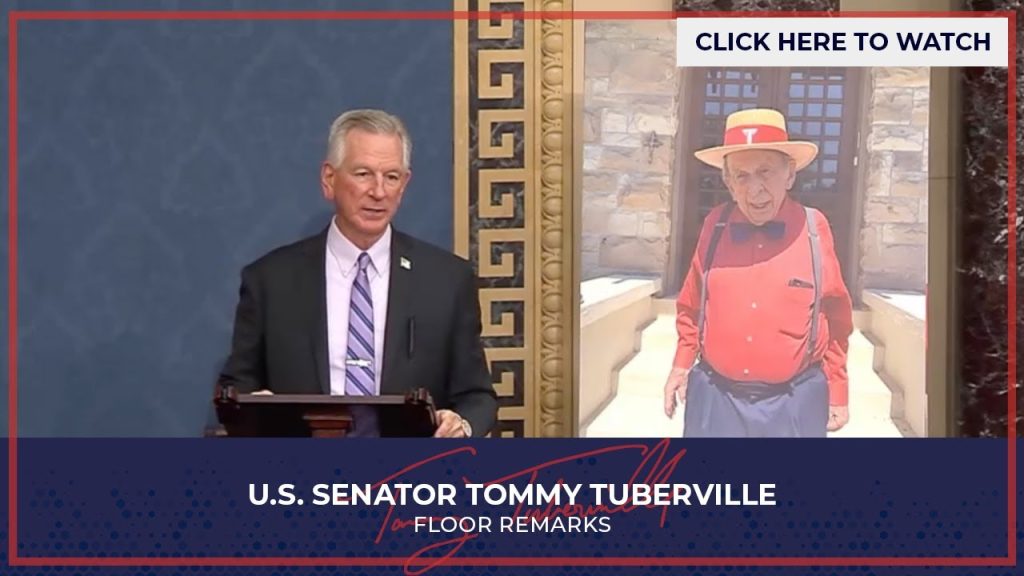

To that end, Tuberville (R-Auburn) and Sen. Jerry Moran (R-Kan.) reintroduced the “Broadband Grant Tax Treatment Act” to amend the Internal Revenue Code and ensure that federal broadband deployment funding will not be considered taxable income.

Grants awarded to broadband providers for the purposes of broadband deployment are currently factored into a company’s income and taxed as income.

The bipartisan legislation moves to exclude broadband deployment grants awarded through certain federal programs from an organization’s income, ensuring the entirety of federal dollars are awarded to companies for the purpose of deploying broadband around the country can be used for that purpose, rather than making their way back to the government through taxes.

“Rural communities are the backbone of our nation, and we want to ensure that Americans living in these communities have access to high-speed internet,” said Tuberville. “Taxing broadband grants would undermine state efforts to prioritize rural broadband expansion. I am proud to support this legislation so that those living in rural America have internet needed to run their businesses, access health care, and pursue educational opportunities.”

Tuberville and Moran are joined by Sens. Shelley Moore Capito (R-W. Va.), Kevin Cramer (R-N.D.), Deb Fischer (R-Neb.), Tim Kaine (D-Va.), Mark Kelly (D-Ariz.), Angus King (I-Maine), Dan Sullivan (R-Alaska), Mark Warner (D-Va.), Raphael Warnock (D-Ga.), and Roger Wicker (R-Miss.) in cosponsoring the legislation.

Tuberville cosponsored this legislation in the 118th Congress.