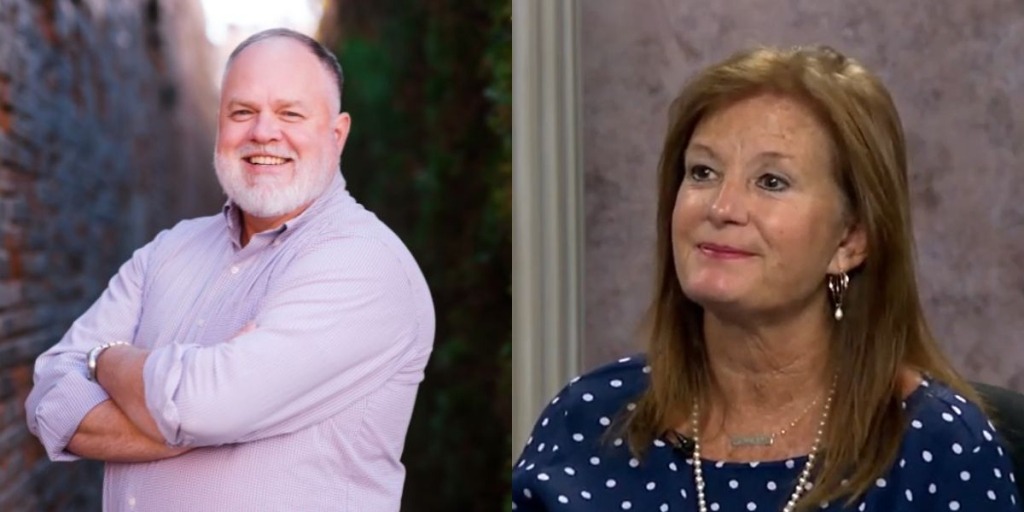

Thursday, the Alabama Senate passed legislation sponsored by State Sen. Tom Butler (R-Madison) to eliminate the state minimum business privilege tax.

Alabama’s minimum business privilege tax is levied on certain corporations, business trusts, limited liability entities and disregarded entities.

In a statement applauding his bill’s Senate passage, Butler outlined the need for the bill given the COVID-19 pandemic-induced hardships small businesses have faced.

“Small businesses are the backbone of Alabama’s economy and pillars in our communities, and the last two years have been the most difficult in decades for these entities,” proclaimed Butler. “While our state budgets are robust, there is a real opportunity to provide substantial support by eliminating the business privilege tax, which will result in an annual $23 million tax cut for our small businesses.”

Butler added, “I am pleased that my colleagues in the Senate recognized the need to move this important piece of legislation forward, and I am eager to see this bill on Governor Kay Ivey’s desk so that we can provide relief for Alabama taxpayers and small businesses.”

The minimum business privilege tax rate is determined by the taxpayer’s taxable income apportioned and allocated to Alabama. Butler’s bill would reduce the tax due for tax year 2023 from $100 to $50. The legislation would provide a full exemption from the state business privilege tax beginning in tax year 2024.

The repeal of the state minimum business privilege tax is part of an effort by the Senate GOP Caucus to pass a series of bills included in a legislative package to provide tax relief to working individuals, small businesses and retirees.

Senate President Pro Tem Greg Reed (R-Jasper) advised that opportunity to repeal the tax is due to the fiscal health of the state’s budgets.

“Alabama’s economy is strong, and our receipts have increased in both the General Fund and Education budgets, presenting an opportunity to provide a tax break for taxpayers and small businesses,” stated Reed. “This bill has a pretty good price tag to it as far as loss of revenue to the state’s budgets, so we have worked closely with the budget chairmen to develop this policy and consider ways to fill the gap. The Senate has prioritized support for Alabama’s businesses, specifically small businesses, and I am proud of the effort that occurred within this legislative body to deliver much-needed relief for Alabamians.”

Senate Majority Leader Clay Scofield (R-Guntersville) praised his Republican colleagues for their support of Butler’s tax relief measure.

“I appreciate Senator Butler’s willingness to spearhead this critical relief for Alabamians,” said Scofield. “The Senate Republican Caucus strives to make Alabama a better place to live, work, and retire, and this meaningful legislation will certainly help us to accomplish that goal. I am proud to be a co-sponsor of the bill, and I am pleased with the Caucus’ overall strong appetite on this important endeavor.”

Upon passage in the upper chamber, the bill now heads to the Alabama House of Representatives for consideration.