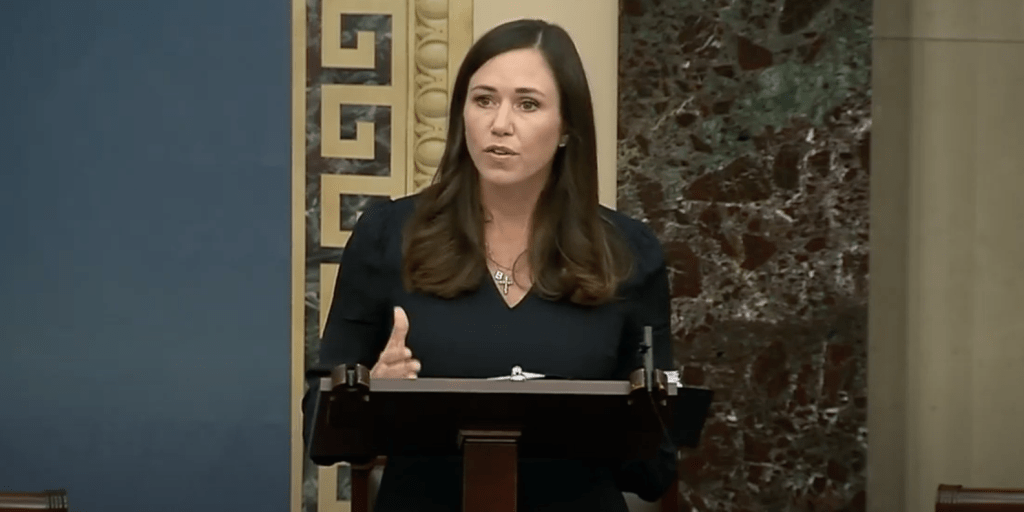

WASHINGTON – To help employees of non-profit organization invest for retirement, Sen. Katie Britt joined fellow Sens. Raphael Warnock (D-Ga.), Dr. Bill Cassidy (R-La.), and Gary Peters (D-Mich.) in reintroducing the bipartisan Retirement Fairness for Charities and Educational Institutions Act.”

The legislation would enhance investment options for 403(b) retirement plans, which are similar to a 401(k). The 403(b) is offered to employees of non-profit organizations such as public universities, hospitals, churches, and charities.

“The Retirement Fairness for Charities and Educational Institutions Act would level the playing field so more hardworking Americans can access retirement resources that best fit their needs,” said Britt. “Our legislation would allow Americans in the non-profit sector to access the same investment options available to those in the private sector.

“This commonsense bipartisan bill would help Americans who work for non-profits, including many of our hospitals, achieve long-term financial stability.”

Warnock, a pastor, is familiar with the work performed by non-profit organizations and their employees.

“America’s retirees deserve the peace of mind that comes with financial security when they transition into retirement,” said Warnock. “This is especially true for non-profit workers who dedicate their lives to serving their communities — they deserve access to the same retirement investment opportunities private sector employees have.

“That’s why I’m proud to help lead this bipartisan legislation which provides equal opportunity for non-profit employees and helps ensure they can retire with dignity.”

The Retirement Fairness for Charities and Educational Institutions Act has received significant support, including the Alabama Association of Nonprofits, American Bankers Association, American Benefits Council, American Heart Association, American Life Insurance Association, American Retirement Association, Aon, Church Alliance, Great Gray, Insured Retirement Institute, Investment Company Institute, March of Dimes, MetLife, Mercer, Mission Square, National Association of Insurance and Financial Advisors, National Council of Nonprofits, Nationwide, Prudential, SPARK Institute, Stable Value Investment Association, United Way, and Vanguard.

“Non-profit employees should have the same access to investment strategies for their retirement plans as private sector employees,” said Cassidy. “Social Security is going insolvent. We need to give Americans every tool to help make their retirement more secure.”

The Retirement Fairness for Charities and Educational Institutions Act would expand retirement savings opportunities for non-profit employees by allowing 403(b) plan participants to invest in collective investment trusts. A CIT is a tax-exempt investment vehicle that provides a diversified, pooled investment option — similar to a mutual fund. CITs offer greater flexibility in investment strategies for retirement plans and reliable, often higher, net returns for plan participants.

“Hardworking public service and non-profit employees who support our health care and human services, arts and culture, civic engagement, and more deserve access to all available financial tools that can help them plan for retirement,” said Peters. “This legislation would put those using a 403(b) plan on a level playing field with other retirement plan participants by allowing them to invest in collective investment trusts, giving them an equal opportunity to achieve their financial goals.”

Under current law, unlike 401(k) holders, 403(b) plan sponsors are not able to use this stable investment option in their plan. This legislation would create parity between 403(b) and 401(k) retirement savings plans, benefitting over 15 million hardworking employees at hospitals, universities, charities, and other non-profit organizations.

“ARA fully supports this legislation that will boost the retirement savings of hard-working employees at hospitals, universities and other non-profit organizations,” said American Retirement Association CEO Brian Graff. “Under the bill, 15 million workers at these organizations throughout the country will now have access in their retirement plan — called a 403(b) plan — to the same lower cost investments that are available to 401(k) plan participants.”