HUNTSVILLE — By now, everyone should have gotten their forms (W-2, 1099, etc.) from their employers or those who have paid you for your services.

Now comes the matter of putting all that down on paper and/or tax preparation software before April 18. The normal tax deadline is April 15 but, since April 15 this year is a Saturday and the next weekday, April 17, is recognized as a holiday, Emancipation Day, in Washington, D.C., the deadline is April 18.

And, if you’re a first-time filer, here are some key things to know, courtesy of Bank Independent.

Why You Should File Your Taxes

It’s important to remember that there are consequences for not filing your taxes. The IRS can impose penalties and interest on what you owe, and they can also take action to collect what you owe. In some cases, the IRS may even file a tax return for you without your input.

The bottom line: It’s always better to file your taxes. And it’s not as hard as you might think, there are plenty of low-cost options available, and the IRS offers helpful resources for first-time filers.

Where to Go to File Your Taxes

When it comes time to file your taxes, you have a few different options. You can go to a tax preparer, file online, or use a software program.

A low-cost option for first-time filers is to use a software program. This is a low-cost way to get your taxes done, and the programs are designed to be easy to use. You can find these programs at your local bookstore or online.

The other option is to go to a tax preparer. This is a more expensive option, but it can be worth it if you have complex taxes or need help filing. You can find tax preparers at your local library or community center, or you can search online.

How to File Your Taxes

Now that you know a bit more about taxes, it’s time to start getting ready to file yours. Here are the basics:

The first thing you need to do is determine where you will file your taxes. You can file with the federal government and with your state government.

Next, you need to figure out how much it will cost to file. There are a number of low-cost options available, including free filing through the IRS website.

Finally, you need to choose which form to use. The most common forms are the 1040EZ and the 1040A.

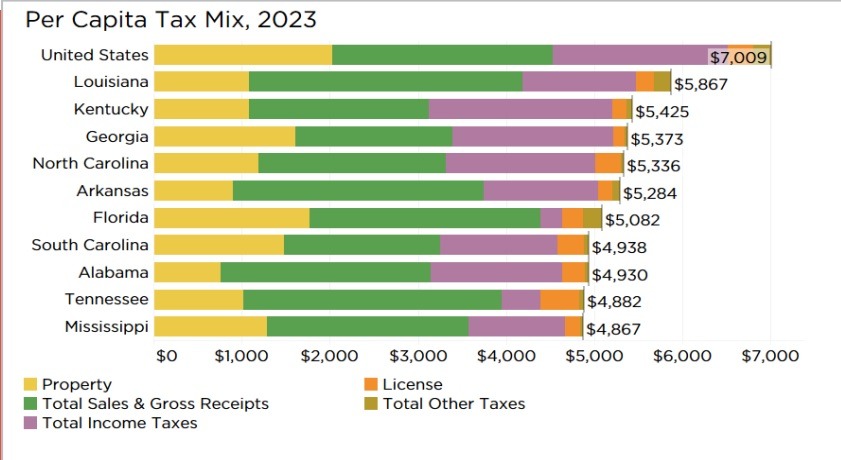

Federal and State Taxes

Most people have to file both federal and state taxes. The process is similar for both, but there are a few differences to keep in mind.

For federal taxes, you’ll use Form 1040 (or the simpler 1040-EZ or 1040-A). You can get these forms from the IRS website, or from a tax preparer. Once you’ve filled out the form, you’ll need to file it with the IRS.

For state taxes, you’ll need to check with your state tax agency to find out which forms you need to fill out. In some states, you can file your state taxes online; in others, you’ll need to mail in a paper return.

The good news is that once you’ve filed your federal taxes, you’ll have most of the information you need to file your state taxes. So even if it seems like a pain to have to do both, it’s not as bad as it sounds!

Tips for Next Year’s Tax Season

Now that you’ve filed your taxes for the first time, it’s a good idea to start thinking about next year’s tax season. Here are a few tips to help you get started:

- Make sure you know when the tax filing deadline is. Next year, it’s April 15.

- Start keeping track of your deductions throughout the year. This will make it a lot easier come tax time.

- If you have any major life changes (got married, had a baby, bought a house, etc.), be sure to let your tax preparer know. These changes can have a big impact on your taxes.

- If you have any questions about taxes, don’t hesitate to ask a tax professional. There are plenty of resources out there to help you learn more about the tax process.

FAQs About Filing Taxes

Now that you have a general understanding of the tax filing process, you might still have some questions. Here are answers to some frequently asked questions about filing taxes.

Do I need to file a tax return?

- If your income is below a certain amount, you may not need to file a return. However, even if you don’t need to file, you may still want to in order to get any refunds you’re entitled to.

How long do I have to file my taxes?

- The deadline to file your taxes is April 15. However, if you can’t meet this deadline, you can request an extension.

How do I know if I owe taxes or if I’m getting a refund?

- You will need to complete your tax returns to figure this out.

Do I need to pay taxes on the money I make from freelancing?

- Yes, you will need to pay taxes on any income you earn, regardless of the source. This includes money from freelancing, tips, alimony, and investments

Now that you know the basics of filing your taxes, you’re ready to get started. Remember to stay organized, take your time, and remember that you can always ask for help if you need it. Filing your taxes doesn’t have to be a daunting task, with a little preparation, you can do it like a pro.

If you have any questions about your taxes, contact a tax preparer, CPA, or other tax professional.